Note: please be sure to see our updated report on the pet services industry in America. Below is the 2019 version, but our newer report is current to 2022.

The Pet Industry in 2019

Introduction: Pet Spending in America

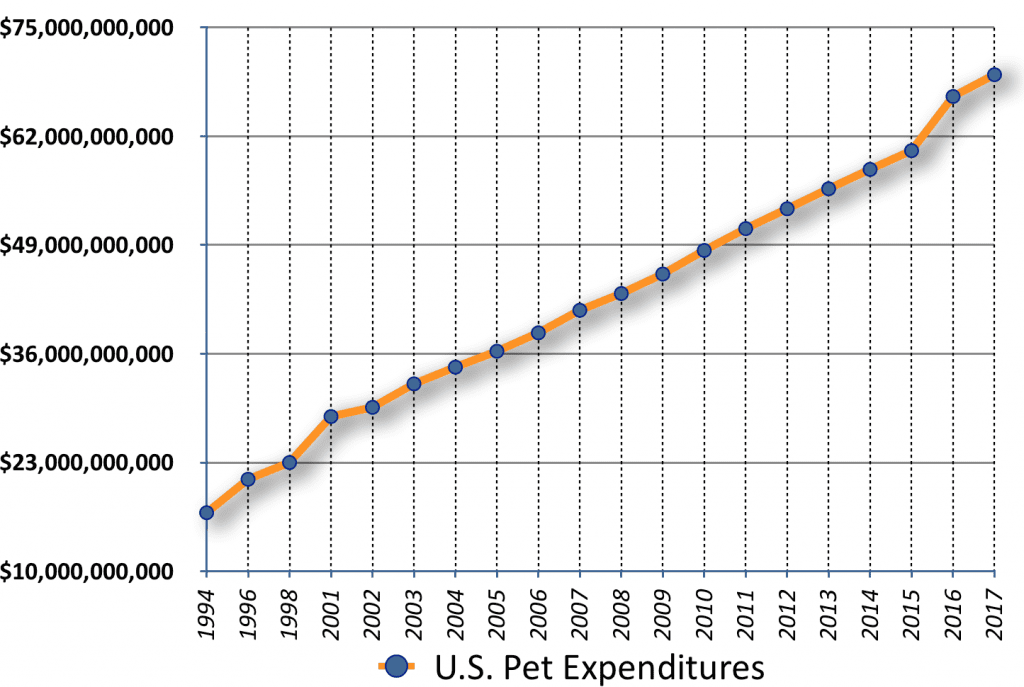

American pet spending has continued to rise every single year since 1994 – even during the 2007-2009 recession – reaching an estimated $72.13 billion in 20181 and now projected to hit almost $100 billion by the end of this decade.2

Specifically in terms of the pet services industry, dog training and pet care expenditures have been increasing with double-digit year-over-year growth.3

Recession-Resistant

Experts agree that the pet industry is virtually “recession-resistant,”4 in large part due to the multi-generational appeal of pets, pervasive treatment of pets as beloved members of the family, increased awareness of the benefits of health and happiness that come from pet ownership, and a social media climate that celebrates our pets.

Brian Beaulieu, an economist with the research and consulting firm ITR Economics, recently told the Pet Industry Leadership Conference that growth in pet expenditures began significantly outpacing all retail sales in 2004 and is currently growing about 50% faster than the retail sector as a whole.5

The U.S. Bureau of Labor Statistics estimated that spending on pets averaged almost $600 per household in 2016. That’s far more than the average amount Americans spent on sporting events, movies, video games, televisions, alcohol, major appliances, etc.6

Pet Ownership in America

Indeed 48% of American households now have a dog (1.49 dogs per household on average), and this steady increase in spending goes hand-in-hand with the economic stability of the typical pet owner. Pet owners have a higher degree of home ownership than the general population, and are also more likely to be married. 70% of dog owners say their spending on their dogs is unaffected by the economy, and an additional 11% report spending more on their dogs when the economic climate dips. In 2016,13% reported that their dogs are allowed in their workplace – up from 8% in 2014.7

The Move Away from Big Box Retailers

In recent years, there have been many headlines about the pet services industry regarding mergers and acquisitions by the big box stores and other conglomerates. It therefore might surprise you to learn that in the past year, 80% of dog owners have shopped at smaller independent pet stores – more than have shopped at big box pet chains.8

All of this is great news for the Zoom Room, and our emphasis on carrying American-made retail products also dovetails with these findings. A whopping 64% of dog owners report that buying American-made dog products is very important to them.9

U.S. Pet Expenditures

Millennials & the Pet Industry

Millennials Lead the Pack

From the 1990s through 2010, the enormous growth of the pet industry was led by the Baby Boomers, but as they begin to age out, the Millennials have exuberantly taken up the mantle of responsible pet ownership and increased spending, and now represent the most important demographic in the industry.

In 2014, American Millennials spent $10.6 billion on their pets, over 15% of the approximately $60 billion spent on pets that year.10

Colin Stewart, Senior Vice President at Acosta – a prestigious sales and marketing firm consulting for many of the largest brands over the past 90 years – acknowledges that Baby Boomers and Millennials “represent the two biggest age groups for pet ownership, which means we can expect continued growth in this category, especially since Millennials are just now entering their prime spending years.” 60% of Millennials purchase nonessential pet items at least once a week, versus 28% of Gen X-ers and 8% of Boomers.11

There are now 83 million Millennials – a larger group than the Boomers – and 62% of them own pets. “About 74% of millennial pet owners own a dog,” said Bob Vetere, president and CEO of the American Pet Products Association. “They not only consider their pets as part of the family, but also consider pets as the next step to actually starting their own human family,” continued Vetere. “They consider their pets as an outward extension of themselves and their own personalities, so they want to be seen together, be it on social media, on trips, errands, even at the workplace.”12

38% of dog owners are Millennials, vs. Baby Boomers at 31% and Gen-X at 26%. And Millennials are more likely to take their dog with them on errands, to work, to pet-friendly restaurants, to buy them gifts, and to pay for pet services.13

David Lummis of Packaged Facts nicely sums up the world view that Millennials have inherited: “Much as computers have always been there for them, millennials know only a world where treating pets like fully entitled family members is normal, if not expected … and expensive.”14

Millennials don’t simply overwhelmingly own pets – of the 18% who don’t, 43% say they hope to have a pet in the future. Indeed, 68% of Millennials believe that raising pets is excellent preparation for having kids one day.15

More than half of Millennials say they’d rather spend money on their pets than on themselves. And they are also highly discerning in what they choose to buy for their pets by way of products and services – with 64% of them actively seeking out products with all-natural ingredients, for example.16

Role of Social Media in Pet Services

Pet owners are certainly no strangers to social media — many pets even have their own Instagram, Facebook or Twitter accounts. The dominance of Millennials has in part driven the tech-savy aspect of pet ownership, with pet owners more likely to use digital devices and technologies compared with non-pet owners, and 41% turning to the Internet for information on pet care services.17

67% of Millennials take photos of their pets regularly, and 63% regularly use social media to share their experiences as pet parents. Any cursory review of Instagram would lead one to conclude that number is quite possibly far closer to 100%!18,19

At the Zoom Room, we not only actively maintain a strong presence on social media to take full advantage of this climate, but we have even developed our own proprietary software to enable our clients to effortlessly share photos and videos of their experiences at the Zoom Room with their own followers across social media channels.

Cause-Based Marketing in the Pet Industry

Since our inception, the Zoom Room has made absolutely central our relationship with local and national animal welfare organizations. We regularly host fund-raising events in our indoor canine event centers and extend benefits to those who have adopted dogs, through partnerships with local shelters and rescue groups.

In fact, consumers increasingly choose their pet vendors based on the role they play in pet welfare and rescue, with the percentage rising from 33% in 2014 to nearly 44% in 2016.20

This collaboration between for-profit and non-profit enterprises, aka Cause Marketing, has definitely benefitted the pet industry as a whole. “The more that animal welfare is recognized as part of the industry, the more that pet owners will embrace” that business, says Steve Monahan, founder of Green Pets America.21

Eco-Friendly Pet Services

Speaking of green, environmental-friendliness also plays a pivotal and very much related role in the success of the Zoom Room and the industry in general. Across all dog owners, 46% say that buying eco-friendly dog products is extremely important.22

A strong driver of this new purchasing pattern is women. “Females make up 70% of the monetary decision-makers for pet products,” says Carol Frank, “and Millennials care about… natural, organic, raw, and other sustainable premium food products. They want pets to follow their own diets.”23

Unsurprisingly, women comprise 82% of Zoom Room customers – a customer base that also includes 91% who are college-educated or higher – another strong factor in making purchasing decisions that favor charitable giving, environmentally-conscious products, and socially-responsible services.

Pets as Family Members

Whether we’re discussing Millennials, Gen X-ers or Boomers, there is one overarching factor that cuts across all age groups that we believe to be the single most powerful driver of the stellar growth of the pet industry: the prevalence of pet parenting, or treating pets as members of the family or even surrogate children – a practice that is so widespread today, but markedly different from generations ago.

Since many American pet owners consider their dogs to be members of the family, they lavish unprecedented spending on their pets. In fact, this treatment of pets like children has been noted not only by economists but also animal behavior specialists who observe significant similarities between training dogs and raising kids.

The family-friendly atmosphere of the Zoom Room caters directly to this trend, and provides owners with the best possible play and learning experiences with their dogs, whom they accompany during all activities in our indoor gyms.

Pet Parenting

The pet parenting trend started with Baby Boomers, and Millennials have hopped on the train, according to Acosta’s report. “Pet owners see their pets as not only companions but cherished family members,” reporting that 94% of pet owners indicate their pet is part of the family, and 80% who treat their pets like their children.24

According to a Purdue University study, more than half of pet owners believe that ”humans have an obligation to provide the best standard of care for dogs that they are capable of.”25

Exercising Dogs: Active Pet Services

Americans have also recognized the multiple health-benefits of dog ownership, not least of which is exercising with your dog – a topic of great interest to us, since at its heart, the Zoom Room is an indoor dog training gym. 48% of Americans say they enjoy exercising with their dog, and 68% report that exercising with their dog is more fun that exercising alone.26

Another way Americans treat their pets as family members is by including them in holidays and other celebrations. This is an area where we’ve seen an especially sharp rise. We regularly host dog birthday parties at the Zoom Room (and, just as common, parties that celebration the anniversary of a rescue’s adoption) – and we’re not alone in witnessing the phenomenon of this sharp rise in demand.

60% of pet owners report celebrating their pets’ birthdays in some fashion, which for more than half of Millennials and 40% of Gen-X pet owners means giving their pets birthday gifts.27

11% of dog owners have thrown parties for their dog (an increase from 7% in 2014), 50% of all pet owners include their pet in family holidays cards, and a whopping 78% of dog owners have purchased holiday gifts for their pup.28,29

SUMMARY: The Pet Industry Today

Researchers who specialize in studying the pet industry have noted its constant rise and recession-proof nature. As to the future, the recent spending activity of the growing Millennials (who have all their best spending years ahead of them) provide substantial confidence in the continuation of these trends far into the future.

At the Zoom Room we believe it is important to stay abreast of our industry and its emerging patterns. This report, based on data from 2014-2018, replaces our previous white paper on the topic. If you’re interested in viewing our prior report, based on 2004-2011 data, you may view it here.

1 “Pet Industry Market Size & Ownership Statistics,” American Pet Products Association, 2018. https://americanpetproducts.org/press_industrytrends.asp

2 “U.S. Pet Market Outlook 2017-2018. Packaged Facts. https://www.packagedfacts.com/Pet-Outlook-10840437/

3 “Industry Statistics & Trends.” 2016-2017 National Pet Owners Survey, American Pet Products Association. 2017. http://americanpetproducts.org/Uploads/MemServices/GPE2017_NPOS_Seminar.pdf

4 Arenofsky, Janice. “The Pet Industry.” Sage Business Researcher. Feb 27, 2017. http://businessresearcher.sagepub.com/sbr-1863-102160-2772364/20170227/the-pet-industry

5 Frank, Carol. “Pet Industry Outlook 2016: The News Just Keeps Getting Better!” Birdseye Consulting. 2016. http://carolfrank.com/pet-industry-outlook-2016-the-news-just-keeps-getting-better/

6 “Average annual expenditures and characteristics of all consumer units, Consumer Expenditure Survey, 2016,” U.S. Bureau of Labor Statistics. 2016. https://www.bls.gov/cex/2016/research/allcuprepub.pdf

7 “Industry Statistics & Trends.” 2016-2017 National Pet Owners Survey, American Pet Products Association. 2017. http://americanpetproducts.org/Uploads/MemServices/GPE2017_NPOS_Seminar.pdf

8 Ibid.

9 Ibid.

10 Phillips-Donaldson, Debbie. “Does Future of Pet Food Market Belong to Millennials?” Petfoodindustry.com, March 2016. https://www.petfoodindustry.com/blogs/7-adventures-in-pet-food/post/5688-does-future-of-pet-food-market-belong-to-millennials

11 “The Pet Parenting Boom,” Acosta, October 2016.

12 Bedwell-Wilson, Wendy. “Are Millennials Generation Pet?” Pet Product News, June 8, 2016. http://www.petproductnews.com/June-2016/Are-Millennials-Generation-Pet/

13 “Industry Statistics & Trends.” op. cit.

14 Lummis, David. “Cashing in on a Perfect Storm of Positive Trends.” Pet Product News. July 2016. http://www.petproductnews.com/July-2016/Cashing-In-on-a-Perfect-Storm-of-Positive-Trends/

15 Sprinkle, David. “How Millennial Pet Owners are Changing the Industry.” Petfoodindustry.com, March 2016. https://www.petfoodindustry.com/articles/5689-how-millennial-pet-owners-are-changing-the-industry

16 Ibid.

17 Packaged Facts. op. cit.

18 Sprinkle, David. op. cit.

19 Acosta, op. cit.

20 Lummis, David. “Acts of Conscience in the Pet Space,” Pet Product News, June 8, 2016, http://www.petproductnews.com/June-2016/Acts-of-Conscience-in-the-Pet-Space/

21 Phillips-Donaldson. op. cit.

22 “Industry Statistics & Trends.” op. cit.

23 Arenofsky. op. cit.

24 Acosta. op. cit.

25 Bir, Courtney; Croney, Candace; and Olynk Widmar, Nicole. “U.S. Residents’ Perceptions of Dogs, Their Welfare and Related Information Sources,” Center for Animal Welfare Science at Purdue University, June 2016. https://vet.purdue.edu/CAWS/files/documents/20160602-us-residents-perceptions-of-dogs-their-welfare-and-related-information-sources.pdf

26 “Industry Statistics & Trends.”op. cit.

27 Acosta. op. cit.

28 “Industry Statistics & Trends.” op. cit.

29 Acosta. op. cit.